What is an escrow account?

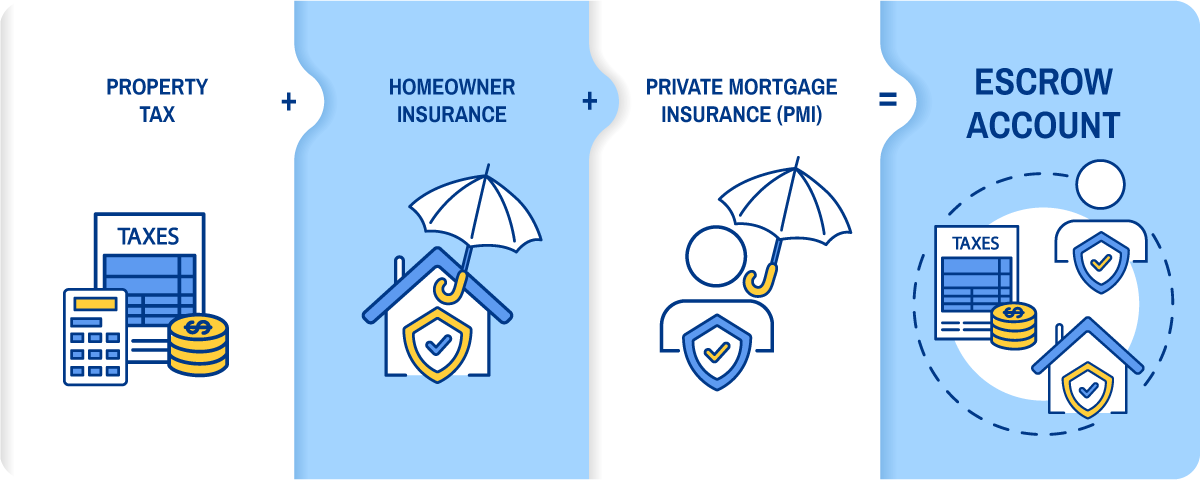

- Mortgage escrow accounts are used to collect and pay insurance and property taxes on a home. When you close on your mortgage, the lender estimates your yearly insurance and tax costs. They then divide that total by 12 months. This amount is then added to your monthly mortgage payment.

What does an escrow shortage or overage mean?

- Escrow analyses are generally done during the anniversary month of the loan origination. If we are asked to do an escrow analysis at a different time, that month becomes the new anniversary date. Escrow statements are generated around the 10th of each month.

- Escrow overages occur when the escrow has left over money in the account after paying property taxes and insurance. In the event of an overage, we will issue a refund check to the mortgage owner.

- Escrow shortages/deficiencies occur when there are not enough funds in the account to make the full payment to your property taxes and insurance. This occurs when the cost of property taxes and/or insurance rise, you change providers, or you made fewer escrow payments than expected. In the event of an escrow shortage, you have two options:

- Pay the shortage/deficiency over the next 12 months: The shortage amount will be totaled up, divided by 12 (months) and added into the upcoming years monthly mortgage payment total.

- Pay the shortage/deficiency in full: Once this has been paid you may request an escrow analysis. In most cases your payment will still change, as we are required to collect 1/12 of the annual amounts for your taxes and insurance.

- How to avoid an escrow shortage:

- Make additional escrow payments to avoid future shortages/deficiencies

- Review your taxes

- Shop around for different insurance coverage. Reach out to one of our Capitol Agency Insurance Agents today. They can help find the best coverage for you.

What if I want to change my insurance?

- You can change your insurance at any time. You may also ask for a new escrow assessment when you make an insurance change. Policy change notifications may be sent to Capitol Federal at [email protected], or to Allied, our insurance servicer, at https://myinsuranceinfo.com/.

What can I do to decrease the real estate taxes on my property?

- You must make an appeal with your county. If your appeal is successful, please send us proof of the change in value. We will then adjust your escrow account.

Understanding how escrow accounts function can help prevent unexpected increases in your monthly payments. Proactively monitoring your taxes, making additional escrow payments and comparing insurance options can help you avoid shortages. If you have questions about escrow accounts, you may call us at 1-888-8CAPFED or visit your local branch.

Connect with Our Loan Professionals

Finding a mortgage lender is more than just an interest rate. It's finding a trusted professional that's spent years preparing for you. Get in touch with one of our trusted and knowledgeable Loan Professionals to start the process of purchasing your dream home.